The order-to-cash (O2C) process is one of the most important lifecycles in any organization. It represents the series of steps a company takes from the moment a customer places an order to the point when payment is collected and the transaction is finalized. This cycle involves several interconnected activities such as order management, credit checks, invoicing, revenue recognition, and payment collection. Because of its central role in driving revenue and cash flow, the order-to-cash process directly impacts customer satisfaction, operational efficiency, and financial performance. Traditionally, companies managed these steps across multiple systems, often resulting in delays, data silos, and inefficiencies. But with the advent of a Salesforce-native ERP for order to cash process, businesses now have the opportunity to streamline this critical function within a single, unified platform.

A Salesforce-native ERP integrates the entire O2C cycle directly into the Salesforce ecosystem, aligning front-office and back-office operations seamlessly. By leveraging the same platform where sales, marketing, and customer service already live, organizations achieve end-to-end visibility and control over their revenue lifecycle. This eliminates the traditional disconnect between CRM and ERP systems, ensuring that every step from order placement to cash collection happens efficiently and transparently. The result is faster order fulfillment, improved financial accuracy, and stronger customer relationships.

One of the key benefits of having the order-to-cash process inside Salesforce is the creation of a single source of truth. In legacy setups, sales teams would close a deal in Salesforce while finance and operations teams relied on separate ERP or accounting systems to process the order, invoice the customer, and manage collections. Data transfers between systems were often manual or dependent on complex integrations, creating risks of errors, duplication, and delays. With a Salesforce-native ERP, once an order is confirmed in Salesforce, it immediately triggers downstream processes such as order fulfillment, invoice creation, and revenue posting without the need for re-entry. This level of automation saves time, reduces errors, and accelerates the entire cycle.

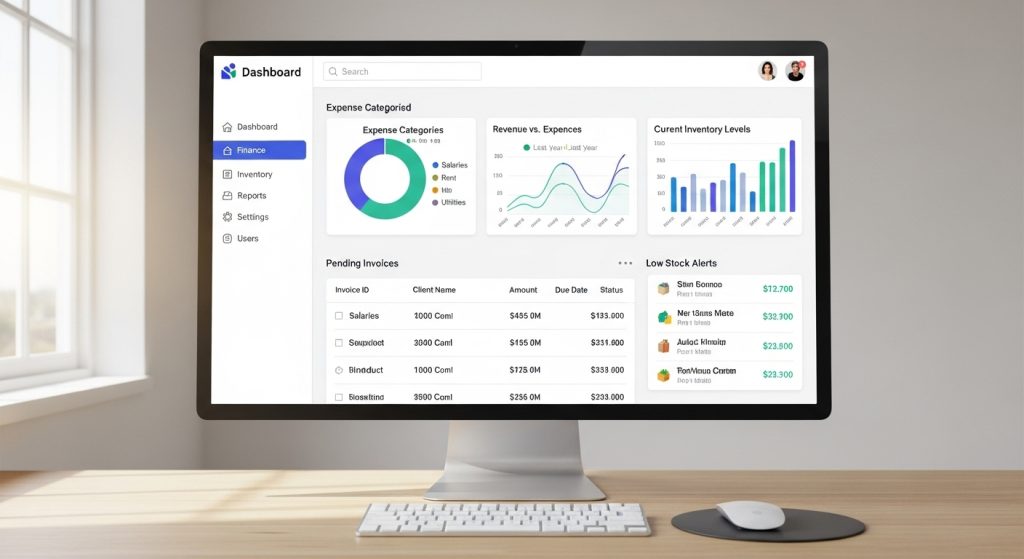

Another major advantage lies in real-time visibility. Because all O2C activities occur in Salesforce, leaders can monitor the status of every order and payment with a single dashboard. Sales managers can see whether invoices have been sent and payments received; finance teams can track accounts receivable aging in real time; and executives can review cash flow projections with confidence. This transparency fosters better decision-making and allows businesses to react quickly to issues such as overdue accounts or supply chain bottlenecks.

Automation also plays a vital role in optimizing the order-to-cash process within Salesforce. Manual tasks such as generating invoices, applying payments, reconciling accounts, and sending reminders can be fully automated. For example, when a customer order is fulfilled, the system can automatically generate and send an electronic invoice. If payment is delayed, automated dunning processes can trigger polite reminders and escalate communications as needed. This reduces the administrative burden on finance teams, shortens the payment cycle, and improves cash flow reliability.

From a customer experience perspective, a Salesforce-native ERP enhances interactions at every touchpoint. Sales representatives can provide customers with accurate information on order status, invoices, and payments without having to contact finance or operations teams. Customer service teams can quickly resolve billing disputes or delivery queries because they have access to complete, integrated data. Faster issue resolution and greater transparency build trust and lead to stronger long-term relationships with clients.

The order-to-cash process also includes critical financial elements such as revenue recognition and compliance. With a Salesforce-native ERP, revenue recognition rules can be applied automatically based on order types, contract terms, or subscription models. This is particularly valuable for industries with complex billing cycles, such as SaaS companies or manufacturers with long-term contracts. By automating these processes within Salesforce, businesses reduce compliance risks, streamline audits, and ensure financial accuracy in line with accounting standards such as ASC 606 or IFRS 15.

Another dimension of the Salesforce-native approach is scalability. As companies grow, they often expand into new geographies, add product lines, or adopt new business models such as subscriptions or usage-based pricing. A native ERP on Salesforce scales with these changes, providing flexibility to adapt workflows, billing structures, and approval hierarchies without the need for costly replatforming. This agility ensures that the order-to-cash process remains efficient and accurate even as the business evolves.

Integration with the broader Salesforce ecosystem further enhances the value of a native ERP. For instance, Marketing Cloud data can inform sales and finance teams of customer promotions that might impact billing. Service Cloud can feed information about support entitlements that influence invoicing or renewals. With everything in one ecosystem, companies gain a holistic view of the customer and ensure that revenue operations align perfectly with customer engagement strategies.

The benefits also extend to analytics and forecasting. Salesforce provides powerful reporting and AI-driven insights that combine sales pipeline data with order fulfillment and payment history. This means leaders can more accurately forecast cash inflows, identify customers with payment risks, and optimize working capital. AI-driven predictions might highlight accounts likely to delay payments, enabling proactive engagement to prevent cash flow issues. For CFOs and finance teams, these insights translate into stronger financial planning and resilience.

Real-world applications of Salesforce-native O2C processes show tangible results. Businesses report faster quote-to-cash cycles, reduced days sales outstanding (DSO), improved collection rates, and fewer billing disputes. By eliminating manual data entry and automating workflows, companies not only save time but also empower employees to focus on strategic tasks such as customer relationships and growth initiatives. Moreover, customers benefit from a smoother, more transparent experience, reinforcing loyalty and driving repeat business.

Of course, organizations must carefully plan the implementation of a Salesforce-native ERP for the order-to-cash cycle. They should begin by mapping current workflows, identifying bottlenecks, and defining desired outcomes. Stakeholder buy-in from sales, finance, and operations teams is crucial to ensure alignment. Training and change management should also be part of the rollout to maximize adoption. Many companies partner with experienced Salesforce ERP providers who bring best practices and industry-specific expertise to accelerate success.

Looking ahead, the future of the order-to-cash process within Salesforce will likely involve even greater use of artificial intelligence and automation. AI will predict customer payment behaviors, recommend optimal credit terms, and automatically adjust collection strategies. Blockchain-based integrations may enhance transparency and trust in transactions, particularly in industries where proof of delivery or authenticity is critical. As digital transformation accelerates, businesses that adopt Salesforce-native ERP solutions today will be well positioned to take advantage of these innovations tomorrow.

In conclusion, a Salesforce-native ERP for order to cash process delivers unparalleled value by unifying sales, finance, and operations within a single cloud ecosystem. It automates workflows, eliminates silos, improves financial accuracy, and enhances customer experiences. From accelerating order fulfillment to strengthening cash flow management, this integrated approach ensures that companies can operate with greater efficiency, agility, and confidence. As organizations seek to grow in a highly competitive and fast-changing environment, embracing a Salesforce-native ERP for the order-to-cash cycle is not just a technology upgrade—it is a strategic move that drives long-term success.